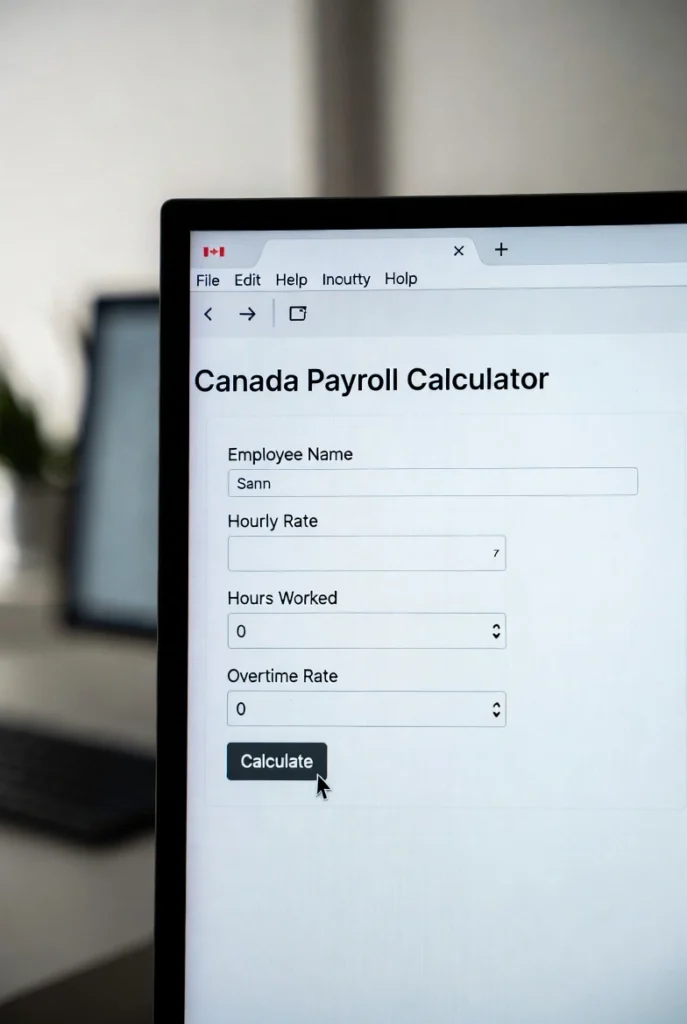

Canada Payroll Calculator

Calculate your 2025 and 2026 payroll deductions for all provinces and territories

Calculator Settings

Enter your gross annual income before deductions

How often you receive your paycheck

How it works

This calculator uses official CRA tax tables and rates. Results are estimates and may vary based on credits and deductions.

Annual Summary

This calculator provides estimates based on 2026 CRA tax tables. Actual deductions may vary based on personal credits, deductions, and other factors. For accurate calculations, please consult a tax professional.

Payroll Deductions Online Calculator

Understanding your paycheck in Canada can often feel like deciphering a complex code. From federal and provincial taxes to Canada Pension Plan (CPP) contributions and Employment Insurance (EI) premiums, numerous deductions impact your take-home pay. For employees and employers alike, accurately calculating these figures is crucial for financial planning and compliance. This is where a reliable payroll deductions online calculator becomes an indispensable tool. This comprehensive guide will demystify Canadian payroll deductions and introduce you to the power of an online calculator, ensuring you always know your true earnings.

Why an Payroll decuctions online Calculator is Essential for Canadians?

In an era where financial accuracy is paramount, relying on manual calculations can lead to errors and frustration. A payroll deductions online calculator offers a streamlined, efficient, and precise solution. Whether you’re an employee eager to understand your net pay salary after tax or an employer ensuring compliance, these tools provide instant insights into:

Demystifying Key Canadian Payroll Deductions

To truly understand your paycheck, it’s vital to grasp the core components of Canadian payroll deductions:

1. Canada Pension Plan (CPP) Contributions

CPP is a mandatory social insurance program designed to provide contributors with retirement, disability, and survivor benefits. Both employees and employers contribute to CPP, with rates and maximums adjusted annually by the government. An accurate payroll deduction calculator will factor in these rates, ensuring correct contributions.

2. Employment Insurance (EI) Premiums

EI provides temporary financial assistance to unemployed Canadians, as well as special benefits for sickness, maternity, parental leave, and more. Like CPP, EI premiums are shared between employees and employers, with specific rates and maximum insurable earnings set each year.

3. Federal and Provincial Income Tax

Income tax is perhaps the most significant deduction. Canada operates on a progressive tax system, meaning higher earners pay a larger percentage of their income in taxes. Both federal and provincial tax rates apply, varying based on your province of residence and income level. Tools like the CRA payroll calculator are invaluable for estimating these complex figures.

4. Other Common Deductions

Beyond statutory deductions, your paycheck might include:

The Power of the CRA Payroll Deductions Online Calculator (PDOC)

The Canada Revenue Agency (CRA) provides its own robust tool, the Payroll Deductions Online Calculator (PDOC). This official resource is crucial for employers and employees seeking precise calculations for federal, provincial (excluding Quebec), and territorial payroll deductions. Utilizing the PDOC ensures compliance with the latest tax laws and regulations, making it a cornerstone for accurate payroll management.

Finding the Best Payroll Calculator for Your Needs

While the CRA’s PDOC is authoritative, many other excellent online payroll calculator options exist, each with unique features. When searching for the ideal tool, consider:

Popular choices often include ADP tax calculator Canada and tools from providers like Payment Evolution and webTOD, which offer specialized functionalities for Canadian businesses.